Forex Trading Course for Beginners: Your Path to Financial Freedom

Forex trading, or foreign exchange trading, is one of the most exciting and potentially lucrative financial activities available today. It involves trading currencies in the foreign exchange market, which is one of the largest and most liquid markets in the world. For beginners looking to break into the world of forex, navigating this complex environment can seem daunting. However, with the right knowledge and resources, anyone can learn how to trade successfully. In this article, we will explore the fundamentals of forex trading and introduce you to a forex trading course for beginners Cameroonian Trading Platforms that can help you get started.

What is Forex Trading?

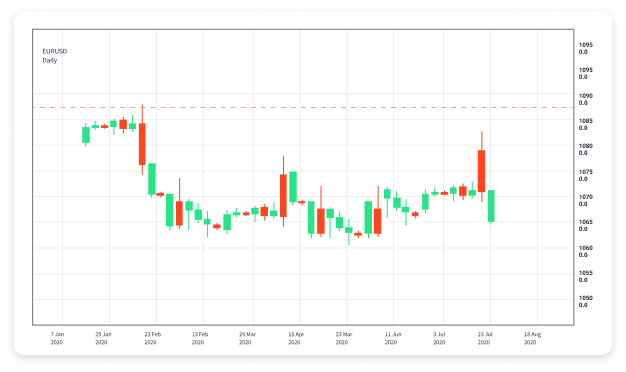

Forex trading is the act of buying and selling currency pairs with the goal of making a profit. In essence, you are speculating on the value of one currency relative to another. For instance, if you believe that the euro will strengthen against the US dollar, you would buy the EUR/USD currency pair. If the euro rises in value, you can sell the pair for a profit. The forex market operates 24 hours a day, five days a week, allowing traders to access it at any time.

The Importance of a Solid Foundation

Before diving into the complexities of forex trading, it’s essential to build a solid foundation. Beginners should take the time to understand key concepts and terminology, including:

- Currency Pairs: Currencies are traded in pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is the base currency, while the second is the quote currency.

- Pips: A pip is the smallest price movement in the forex market, usually representing a one-digit movement in the fourth decimal place.

- Leverage: Leverage allows traders to control a large position with a relatively small amount of capital. While this can amplify profits, it also increases the risk of losses.

- Margin: This refers to the amount of capital required to open and maintain a leveraged position.

Choosing a Trading Platform

Selecting the right trading platform is crucial for success in forex trading. There are many platforms available, each offering various tools, resources, and features. Look for a platform that:

- Is user-friendly and intuitive, making it easy for beginners to navigate.

- Offers a demo account to practice trading without risking real money.

- Provides access to educational resources, including webinars, tutorials, and articles.

- Has robust security measures to protect your funds and personal information.

Developing a Trading Strategy

One of the most critical aspects of forex trading is having a well-defined trading strategy. A good strategy can help you manage risk and maximize profit. Here are some essential components to consider when developing your strategy:

- Technical Analysis: This involves analyzing price charts and indicators to identify trends and potential entry and exit points.

- Fundamental Analysis: Understanding economic indicators such as interest rates, inflation, and employment rates can help you make informed trading decisions.

- Risk Management: Establishing rules for how much capital you are willing to risk on each trade is vital to protect your trading account from significant losses.

Practicing with a Demo Account

Many brokers offer demo accounts that allow you to practice trading with virtual money. Utilizing a demo account is an excellent way to familiarize yourself with the trading platform and test your strategy without the pressure of real money at stake. Use this opportunity to learn from your mistakes and refine your approach before transitioning to a live trading environment.

Getting Started with Forex Trading

Once you have a firm understanding of the fundamentals and have developed a trading strategy, it’s time to get started. Here’s a step-by-step guide:

- Sign up with a broker: Choose a reputable forex broker that meets your needs and open an account.

- Fund your account: Deposit money into your trading account using one of the accepted payment methods.

- Practice on a demo account: Before trading real money, use the demo account to practice and adjust your strategy.

- Start trading: Begin trading with a small amount of capital, gradually increasing your position as you gain more experience and confidence.

Staying Informed

The forex market is constantly changing, influenced by economic news, geopolitical events, and market sentiment. To be a successful trader, you must stay informed about global events and how they might affect currency values. Subscribing to financial news outlets, following market analysts, and engaging with trading communities can enhance your understanding and keep you updated.

The Importance of Emotions in Trading

Trading can evoke a wide range of emotions, from excitement and joy during profitable trades to fear and frustration during losses. Managing your emotions is crucial for maintaining a disciplined approach to trading. Develop a trading plan, stick to it, and avoid making impulsive decisions based on emotions.

Continuous Learning and Improvement

Forex trading is a constant learning process. Markets evolve, and new strategies emerge, making it essential to continue your education. Participate in trading courses, attend webinars, read books, and engage with experienced traders to enhance your skills.

Conclusion

Forex trading offers a world of opportunities for those willing to take the time to learn and develop their skills. By understanding the fundamentals, practicing on demo accounts, and continuously improving your knowledge, you can pave the way for successful trading. Remember to choose the right trading platform, establish a sound strategy, and manage your emotions to increase your chances of success in the forex market.

Whether you are looking to supplement your income or achieve financial independence, a well-structured forex trading course can set you on the right path. Embrace the journey, commit to your education, and you may find that forex trading is not just a way to make money, but a rewarding and fulfilling endeavor.